Term Life Insurance Ontario – Affordable Protection for Families Across Ontario

Welcome to Dave Financial Services Inc., your trusted source for term life insurance in Ontario. We specialize in providing affordable life insurance coverage tailored to your family's needs and budget.

What is Term Life Insurance?

Term life insurance is a cost-effective solution that provides financial protection for your loved ones. It covers you for a specific term—typically 10, 20, or 30 years. If the policyholder passes away during the term, beneficiaries receive a tax-free lump sum payout.

Term Life Insurance is ideal for:

- Young families with children.

- Main Income Earners.

- Homeowners with a mortgage.

- Business owners.

- People Planning to Convert Insurance Later to Whole Life.

- Immigrants or Newcomers to Canada.

- People with Temporary Debts.

- Anyone seeking low-cost life insurance in Ontario.

Why Choose Term Life Insurance?

Term life insurance is one of the most affordable and straightforward ways to protect your family’s financial future. Whether you’re a new parent, homeowner, or young professional in Ontario, term life can provide the right coverage when you need it most.

Key Features

1. Tax-Free Growth

Term life insurance offers high coverage at low cost. It’s ideal for:

- Young families on a budget.

- First-time homeowners.

- People who need maximum protection without high monthly payments.

- Example: A healthy 30-year-old can get $500,000 of coverage for less than $30/month.

2. Flexible Coverage Options

Choose a term that fits your needs:

- 10, 15, 20, or 30 years.

- Matches your mortgage, children’s education timeline, or retirement plan.

- This makes term life insurance in Ontario highly customizable.

3. Protects Your Loved Ones

If you pass away during the term, your beneficiaries receive a tax-free lump sum. This money can:

- Replace lost income.

- Pay off debts or mortgage.

- Cover children’s education.

- Handle final expenses.

4. Convertible to Permanent Insurance

- Most term policies in Canada allow you to convert to permanent life insurance without a medical exam, giving you future flexibility.

5. Simple & Easy to Understand

No complex investment components or hidden fees. It’s pure protection:

- Apply quickly.

- Know exactly what you’re paying for.

- Focused on peace of mind.

Term Life Insurance vs. Whole Life Insurance: What’s the Difference?

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Duration | Temporary | Lifetime |

| Premiums | Lower | Higher |

| Builds Cash Value? | ✗ No | ✓ Yes |

|

| Conversion Option | ✓ ften Available | ✗ Not Applicable |

| Best For | Short-term coverage | Long-term planning |

How Does Term Life Insurance Work?

1. Select:

Choose your term length: You'll select how long you want the policy to be active (e.g., 10, 20, 30 years).

Choose your coverage amount: This is the death benefit your beneficiaries will receive.

Choose the company: choose a life insurance provider, factors beyond cost—such as financial stability, claims process, customer service, product offerings, and the company’s reputation.

2. Apply:

Provide information:

You'll need to provide personal information, such as your name, age, and health status, and may need to undergo a medical exam.

Underwriting:

The insurance company will assess your application based on the information provided and determine if you are eligible for coverage and the premium rate.

3. Pay Premiums:

premiums:

Term life insurance typically has level premiums, meaning your premium cost will remain the same for the duration of the term.

payments:

You'll make regular premium payments, usually monthly or annually, to keep your policy active.

3. Coverage and Payout:

Death benefit:

If you die while the policy is active, your named beneficiary will receive the death benefit.

Renew or convert:

At the end of the term, you can usually renew the policy (but at a higher premium), convert it to a permanent policy, or let it lapse.

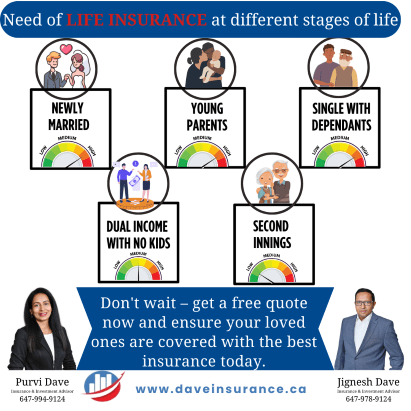

Who Needs Term Life Insurance in Ontario?

- Young adults looking to begin smart financial planning.

- New homeowners securing life insurance for mortgage protection.

- Parents funding future education.

- Immigrants building stability in Brampton, Scarborough, and beyond.

- Entrepreneurs protecting business and family income.

- Couples looking for joint coverage.

- Seniors needing short-term term life insurance for Seniors.

FAQ – Term Life Insurance Ontario

We compare top insurers like Sun Life, Canada Life, Manulife, BMO, RBC, and Equitable life to get you the best match.

As low as $20/month for a healthy 30-year-old non-smoker.

That depends on your life stage. Our advisors help you decide based on your goals.

Yes—many no-medical plans are available for qualified applicants.

We work with a wide range of providers to offer cheap term life insurance rates based on your life stage and needs.

Absolutely—it's the most affordable time to lock in low rates and protect your future.

Yes, you can! Layered life insurance (life insurance laddering) involves having multiple term policies with different coverage amounts and lengths. This strategy helps match your coverage to your changing needs over time—like covering a mortgage now and reducing coverage later as your financial responsibilities decrease. It’s a smart way to get customized protection without overpaying.

Areas We Serve

Looking for the Best Term Life Insurance / Cheapest Term Life Insurance or wondering how much term life insurance you need? Please Contact Dave Financial Services Inc. We can guide you every step of the way.

Contact your best Insurance agent near you today! - Dave Financial Services Inc.

- Term life insurance in London.

- Term life insurance in Mississauga.

- Term life insurance in Hamilton.

- Term life insurance in Brampton.

- Term life insurance in Etobicoke.

- Term life insurance in Scarborough.

- Term life insurance in Kitchener, Cambridge, Waterloo, Woodstock.

Get the Lowest Term Life Insurance Quote Today!

Ready to protect what matters most? Whether you’re searching for affordable term life insurance near me, need help choosing between term life vs whole life insurance in Canada then Contact Dave Financial Services Inc.

Get your free, no-obligation term life quote online now!

Your peace of mind is just a few clicks away.