Build Tax-Free Wealth with a TFSA in Ontario – Dave Financial Services Inc.

Canadians save for many different purposes over their lifetime, including to purchase a car, renovate a house, start a small business, take a family vacation, or retirement. Canadians can use several governments-registered programs TFSA is one of the registered programs.

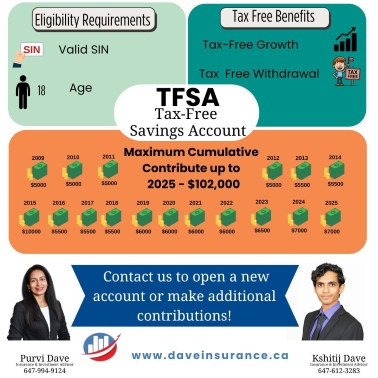

The federal government introduced Tax-Free Savings Accounts in 2009. TFSA allowed people to tax-shelter their money. As per statistics Canada in 2016 more than half of Canadians (63%) have a tax-free savings account. It’s a government-approved way to make tax-exempt money and still receive income-based benefits.

A tax-free savings account (TFSA) is more than just a savings account. You can withdraw, invest, or earn interest, and that money still won’t be taxed. Although it is very popular investment product many Canadian still don’t understand how contribution limits and withdrawal rules work for these accounts.

All About TFSA?

A Tax-Free Savings Account (TFSA) is a government-registered account that allows Canadians to earn interest, dividends, and capital gains tax-free. You can contribute after-tax dollars to your TFSA and invest in a wide variety of options—such as mutual funds, ETFs, GICs, stocks, cash and bonds. Unlike an RRSP, withdrawals from a TFSA are not taxed and can be made at any time for any reason. This makes the TFSA a top choice for both short- and long-term savings.

How Much Can You Save in Your TFSA?

Your TFSA contribution limit is based on your age and residency. As of 2025, the annual TFSA limit is $7,000, and the total cumulative room since 2009 is over $102,000 if you’ve been eligible since the beginning and have never contributed. At Dave Financial Services Inc., we’ll help you develop a personalized contribution plan that suits your budget and maximizes your tax-free growth potential.

Find Out Your TFSA Contribution Room

To check your available TFSA contribution room, you can log into your CRA My Account online or contact the Canada Revenue Agency directly. It’s important to track your contributions to avoid overcontributing, as the CRA does not monitor your account in real time. If you need help reviewing your room or building a tax-free savings strategy, our Ontario-based TFSA advisors are here to support you.

Key Benefits of Tax-Free Savings Accounts

1. Tax-Free Growth

All investment income — including interest, dividends, and capital gains — earned within a TFSA is completely tax-free, even when withdrawn.

2. Flexible Withdrawals

You can withdraw money from your TFSA at any time, for any reason, without paying taxes or penalties.

3. Contribution Room Reinstatement

Any amount you withdraw is added back to your contribution room the following year, giving you the flexibility to re-contribute later.

4. No Impact on Government Benefits

TFSA withdrawals do not affect income-tested benefits like Old Age Security (OAS), the Guaranteed Income Supplement (GIS), or the Canada Child Benefit (CCB).

5. Wide Range of Investment Options

TFSAs can hold various investments, including mutual funds, ETFs, stocks, bonds, and GICs, allowing you to grow your wealth strategically.

6. No Age Limit for Contributions

Unlike RRSPs, there’s no maximum age to contribute to a TFSA, making it an excellent tool for retirement planning even after age 71.

4 Common TFSA Mistakes to Avoid in Ontario

The Tax-Free Savings Account (TFSA) is one of the most powerful tools for tax-free investing and saving in Canada. But many Ontarians unknowingly make costly mistakes that reduce the potential benefits of their TFSA. Here are four common TFSA mistakes to avoid:

1. Holding Only Cash in a TFSA

Treating a TFSA like a simple savings account limits its potential, as holding only cash yields minimal growth, whereas investing in assets like stocks, ETFs, or GICs allows your money to grow tax-free and more effectively.

2. Withdrawing TFSA Cash to Open Another TFSA

Some people mistakenly withdraw TFSA funds to move to another provider and re-contribute the same amount in the same year, unknowingly triggering over-contribution penalties.

3. Over-Contributing to a TFSA

Exceeding your TFSA contribution limit set by the CRA can lead to a costly 1% monthly penalty, so it's crucial to track your contributions and check your available room through your CRA My Account.

4. Not Opening a TFSA at All

Many Canadians delay opening a TFSA, missing out on valuable tax-free growth, even though starting early with small, consistent contributions can lead to significant long-term benefits.

Successor Holder vs. Beneficiary for TFSA

When setting up your Tax-Free Savings Account (TFSA) in Ontario or anywhere in Canada, you have the option to name either a successor holder or a beneficiary — and the difference is significant:

Successor Holder (Only for Spouse or Common-Law Partner)

- Who can be named? Only your spouse or common-law partner.

- What happens? Upon your death, your TFSA transfers directly to your spouse with no taxes, no probate, and no impact on their own TFSA contribution room.

- Why it matters: Your spouse continues the TFSA as-is, keeping it tax-free and fully sheltered.

It is very Seamless, tax-free transition of your TFSA to your partner with continued growth.

Beneficiary (Anyone Else)

- Who can be named? A spouse, child, family member, or anyone else.

- What happens? The TFSA funds are paid out tax-free, but the account itself is closed, and any growth after death may be taxed.

- Spousal Note: If a spouse is named as a beneficiary (not a successor), they can transfer the funds to their own TFSA, but it uses up their contribution room.

TFSA Withdrawal Facts Every Canadian Should Know

Withdrawing from your Tax-Free Savings Account (TFSA) in Ontario — or anywhere in Canada — is simple and flexible, but it’s important to understand the rules. Here are the key facts:

No Withdrawal Fees (Except Investment Commissions)

There are no government withdrawal fees for TFSA accounts. However, if you're selling securities (like stocks or ETFs), your investment provider may charge standard trading commissions.

Contribution Room Restored Next Year

When you withdraw funds from a TFSA, that amount is added back to your contribution room the following calendar year, not immediately.

Withdrawals Are Tax-Free

Since TFSA contributions are made with after-tax income, withdrawals are generally not taxed — including any investment gains.

However, exceptions may apply, such as holding non-qualified investments or contributions made while a non-resident of Canada. Always check the latest rules at Canada.ca. Contributions, withdrawals and transfers - Canada.ca

No Mandatory Withholding for Non-Residents

If you're a non-resident, there’s no mandatory tax withholding when withdrawing from a TFSA — but you may still face penalties if you contribute while non-resident.

Withdrawals in CAD or USD

TFSA withdrawals can be completed in Canadian or U.S. dollars, depending on your account type and investment provider.

Penalties for Breaking TFSA Rules

Breaking TFSA rules can lead to costly penalties, especially if you over-contribute beyond your available room, the Canada Revenue Agency (CRA) charges a 1% monthly tax on the excess amount. Contributing while you’re a non-resident also incurs the same 1% monthly penalty until withdrawn. Re-contributing withdrawn funds in the same year without available room counts as an over-contribution and is penalized. Holding non-qualified investments inside your TFSA may result in taxable income and disqualification of those assets. To avoid these penalties, always track your contribution room carefully and use only approved investments.

FAQs – Tax-Free Savings Accounts in Ontario

The CRA charges a 1% penalty per month on the excess amount until it's withdrawn, or new room becomes available.

Only if you have available contribution room. Otherwise, it’s considered an over-contribution and may be penalized.

No — and doing so results in a 1% monthly tax on each dollar contributed while non-resident.

Non-qualified investments like certain private shares or foreign property may be taxable and could lead to penalties.

Track your contributions, check your CRA My Account, and speak with a licensed advisor to stay compliant.

Areas We Serve:

- TFSA in Toronto.

- TFSA in Mississauga.

- TFSA in Brampton.

- TFSA in Hamilton.

- TFSA in Scarborough.

- TFSA in Vaughan.

- TFSA in Markham.

- TFSA in Milton.

- TFSA in Kitchener.

- TFSA in London Ontario.

- TFSA in Waterloo.

- TFSA in Windsor Ontario.

- TFSA in Barrie.

- TFSA near me any area in Ontario