Whole Life Insurance in Canada – Lifetime Protection That Grows with You

Looking for the best whole life insurance in Ontario or searching for whole life insurance near me? You're in the right place. At Dave Financial Services Inc., we help individuals and families across Ontario find guaranteed life insurance coverage with cash value growth, tax benefits, and long-term financial security—all in one flexible, affordable policy.

- Serving: Toronto, Mississauga, Brampton, Hamilton, Scarborough, Vaughan, Kitchener, London, and surrounding cities.

What Is Whole Life Insurance?

Whole life insurance is a type of permanent life insurance in Canada that provides lifelong coverage and a guaranteed tax-free payout to your beneficiaries. In addition to insurance protection, it builds cash value over time, which you can access while you’re still alive.

Benefits of Whole Life Insurance:

- Lifetime protection with no expiry.

- Fixed premiums that never increase.

- Tax-sheltered cash value growth.

- Access to policy loans or withdrawals.

- Tax-free inheritance for your family.

How Whole Life Insurance Works

- Choose your coverage amount (e.g. $100,000 to $1M+).

- Pay fixed monthly or annual premiums.

- Your policy builds guaranteed cash value.

- Access funds when needed.

- Upon death, your family receives a tax-free lump sum.

- Coverage available in: Toronto, Mississauga, Brampton, Hamilton, Vaughan, and more.

Who Should Consider Whole Life Insurance?

Whole life insurance is ideal for:

- Parents planning their children’s financial future.

- Business owners in Mississauga, Toronto, and Brampton.

- Seniors planning for final expenses and estate taxes.

- New Canadians building a long-term financial legacy.

Whether you’re in Scarborough or Kitchener, whole life insurance offers a lifetime of peace of mind.

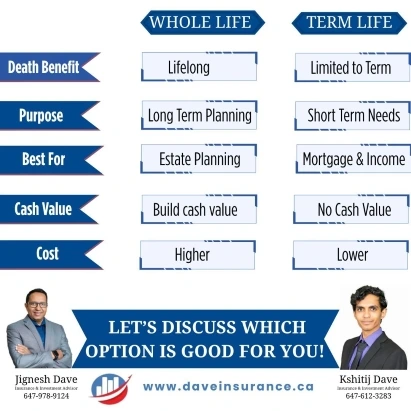

Whole Life vs. Term Life Insurance

| Feature | Whole Life Insurance | Term Life Insurance |

|---|---|---|

| Coverage Duration | Lifetime | 10, 20, 30, or 40 years |

| Premiums | Fixed for life | Lower, but may increase |

| Cash Value | Yes | No |

| Cost | Higher | Lower |

| Best For | Long-term goals, estate planning | Short-term needs (e.g. mortgage) |

Popular in: Toronto, Milton, Oakville, Guelph, Windsor

Types of Whole Life Insurance Available

- Participating Whole Life Insurance – Earn annual dividends.

- Non-Participating Whole Life – Guaranteed, straightforward coverage.

- Limited Pay (10, 20 years) – Pay off early, stay covered for life.

- Joint Whole Life Insurance – Ideal for couples planning estates.

- No-Medical Whole Life Plans – Great for seniors or those with health conditions.

Areas We Serve

- Whole life insurance in Oakville.

- Whole life insurance in Mississauga.

- Whole life insurance in Hamilton.

- Whole life insurance in Brampton.

- Whole life insurance in Etobicoke.

- Whole life insurance in Scarborough.

- Whole life insurance in Kitchener, Cambridge, Waterloo, Woodstock .

Frequently Asked Questions (FAQs)

Yes—if you value lifetime coverage, fixed premiums, and cash value growth, it’s an excellent long-term solution.

Yes! You can borrow against or withdraw the cash value for things like emergencies, education, or retirement.

Not always. No-medical whole life plans are available, especially for seniors or those with pre-existing conditions.

Yes! You can borrow or withdraw from your cash value to fund education, retirement, or emergencies.

We partner with top Canadian insurers: Sun Life, Manulife, Canada Life, RBC, iA Financial, BMO Insurance, and more.

It depends on your age, health, and coverage amount. Contact us for a personalized quote.

It depends on your goals. Whole life is ideal for long-term planning, while term is more affordable short-term. We’ll help you choose the best fit.

Yes, because it combines lifelong protection with cash value accumulation. However, it can provide better cost-efficiency over the long run if held as a permanent policy.